ABOUT FIBONACCI FORECAST

A Sr. Quantitative Researcher with 14 years’ experience with a predictive Alpha Fibonacci trading strategy; identifying in advance market crashes, market rallies, institutional entries, exits across all instruments in all market conditions. Experienced quantitative researcher working alongside portfolio managers, developers, hedge fund traders and with financial institutions. Brings a solid commitment to excellence with knowledge and experience in quantitative research, predictive modeling and developing systematic trading. Delivers substantial increases to ROIs for hedge funds and institutional clients in the U.S and Globally. Has built a solid reputation through trust, respect, and daily practices in highly visible strategic roles driving revenue growth. Possesses outstanding communication and research skills, works well independently and in collaborative team environments.

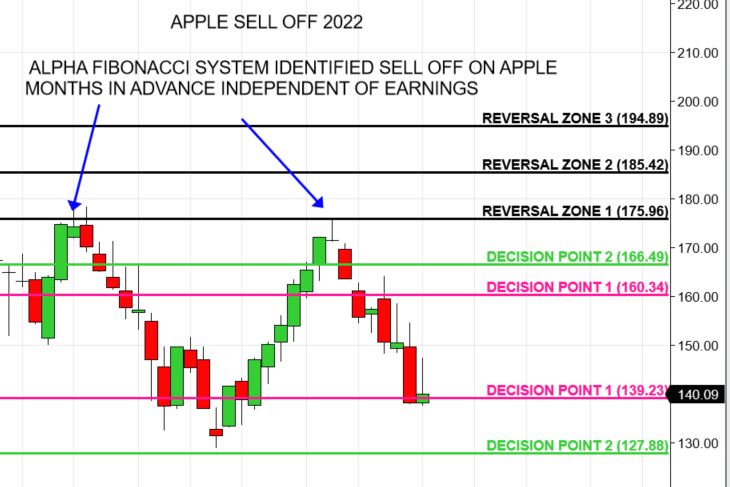

The Fibonacci Forecast identifies institutional crashes and rallies in advance, independent of news events and prior to earnings across all instruments.

Fibonacci Forecast utilizes a Predictive Proprietary Alpha Fibonacci System developed by Alla Peters-Plocher in 2008. Alla was fascinated by Fibonacci during the collapse in 2008 and devoted her time to developing her own Predictive Alpha Fibonacci System with a focus on predictive institutional trend inception and trend reversals across all instruments in all market conditions.

The usefulness of the Fibonacci Forecast research is in predictive qualities that identify institutional entries and exits in advance. The predictive precision of the Alpha Fibonacci System is what has attracted US and global hedge funds and institutions. Many of the Alpha Fibonacci contrarian calls have proven to be highly accurate, such as Amzn, Bitcoin, Tesla, Netflix collapses despite earnings and hype.

Fibonacci Forecast simplifies price action into an indicator-free Predictive Proprietary Alpha Fibonacci technique which methodically identifies highly accurate long-term trend inception and trend reversal levels. This is the means by which the predictive system notes market turning points long before fundamental or traditional technical analysis is capable of doing so.

Unlike traditional technical research, the predictive proprietary Fibonacci Forecast is designed to work with traditional fund management to identify key entry and exit strategies independently or as an adjunct to regular, key fundamental research.

These proprietary Predictive Alpha Fibonacci Reversal zones are specifically designed to increase ROI and decrease the noise surrounding the increasingly unreliable fundamental signals coming from the expanding media-driven influences in today’s confounding investment marketplace.

In recent markets:

Fibonacci Forecast identified institutional rallies across multiple instruments in 2020 despite covid crisis, bonds sell off 2020, Amazon, Appl, TSLA sell offs and rallies 2022 prior to earnings, crypto crash 2022 despite hype, oil rally 2020, Euro and Pound sell off 2022 and multiple other examples. Which can be reviewed.

Note: This service is not available to individual investors.